Key Highlights:

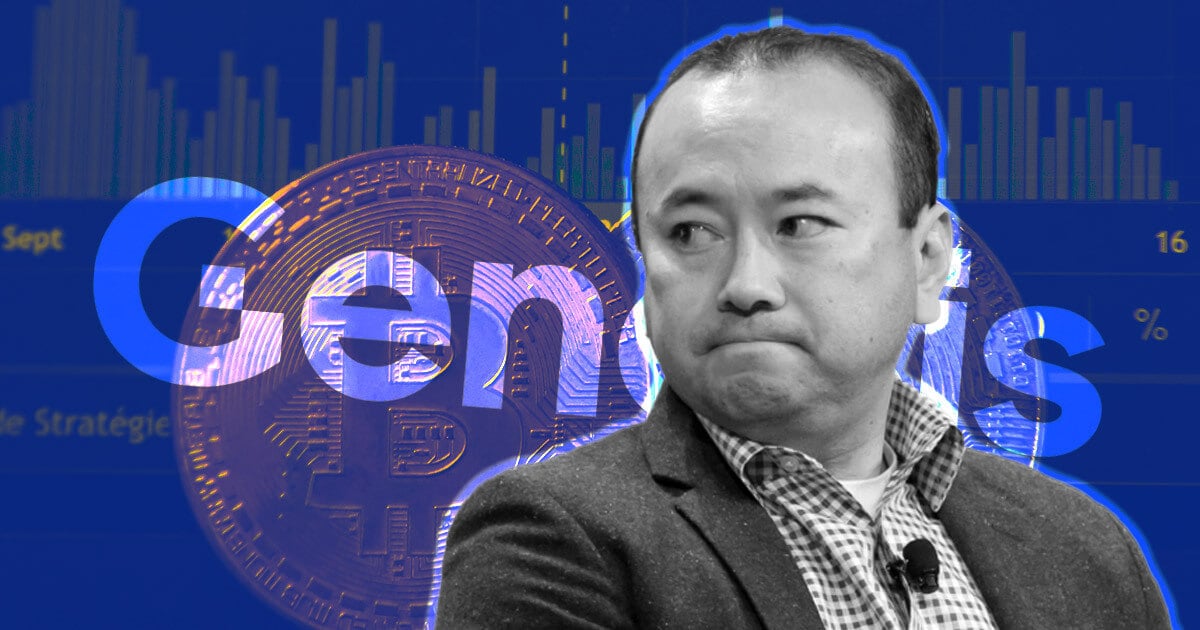

- Soichiro “Michael” Moro, former CEO of Genesis Global Capital, LLC, has been penalized by the SEC for misleading investors.

- Moro’s actions, including misleading statements and improper financial representations, resulted in a $500,000 civil penalty.

The U.S. Securities and Exchange Commission (SEC) has sanctioned Soichiro “Michael” Moro, former CEO of Genesis Global Capital, LLC, for engaging in negligent behavior that misled investors during a financial crisis in 2022.

Genesis operated a crypto asset lending program, pooling investor assets and lending them to institutional borrowers like hedge funds.

In June 2022, the hedge fund Three Arrows Capital (TAC) defaulted on loans worth $2.4 billion, creating a significant financial shortfall for Genesis.

The default led to a $1 billion gap in Genesis’s balance sheet, jeopardizing its operations and solvency.

Misleading Conduct

Moro’s actions during this period included approving public statements that misrepresented Genesis’s financial health:

- A June 15, 2022, tweet claimed Genesis’s balance sheet was “strong,” despite the $1 billion shortfall.

- On June 17, 2022, Moro falsely stated that Genesis had “shed the risk” from TAC’s default, even as the company remained exposed to fluctuations in the collateral value.

In an attempt to mask the financial issues, Digital Currency Group (DCG), Genesis’s parent company, issued a $1.1 billion promissory note on June 30, 2022. This note artificially inflated Genesis’s balance sheet, showing positive equity while providing no actual financial relief. Moro failed to disclose the note’s terms to investors, misleading them about DCG’s involvement in resolving the crisis.

Regulatory Violations

The SEC found that Moro’s conduct violated Section 17(a)(3) of the Securities Act, which prohibits actions that defraud or mislead investors. Negligence was deemed sufficient to establish the violation.

Penalties Imposed

Under the SEC’s order:

- Moro must cease and desist from any further violations of securities laws.

- He has been fined $500,000, payable within 30 days.

- Moro’s actions and the associated penalties will be treated as violations for bankruptcy and other legal purposes.